When applying for a mortgage loans, lenders evaluate several eligibility criteria to determine a borrower’s ability to repay the loan.

Eligibility Criteria for Mortgage Loans in the United States

Obtaining a mortgage loans in the United States requires meeting specific eligibility criteria set by lenders. These criteria help financial institutions assess the borrower’s ability to repay the loan. Below are the key factors that determine mortgage loan eligibility:

1. Credit Score

A borrower’s credit score plays a crucial role in mortgage approval. Most lenders require a minimum credit score of 620 for conventional loans. However, government-backed loans like FHA loans may accept lower scores, typically around 500-580. A higher credit score can lead to better interest rates and loan terms.

2. Income and Employment Stability

Lenders assess income levels and employment stability to ensure the borrower has a reliable source of income. Typically, borrowers need to provide pay stubs, tax returns, and bank statements for the last two years. Self-employed individuals may need to provide additional documentation.

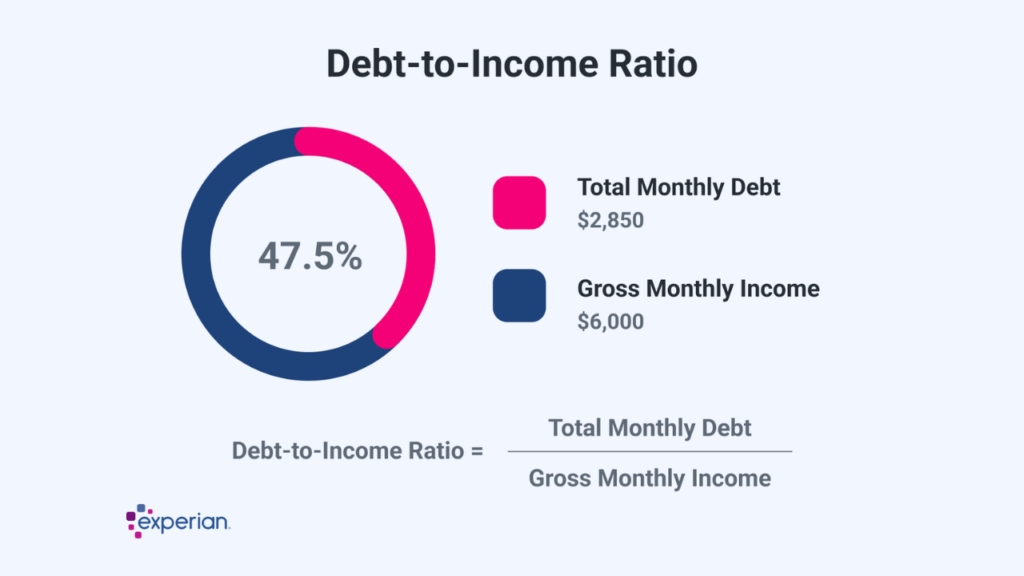

3. Debt-to-Income Ratio (DTI)

The debt-to-income ratio is the percentage of a borrower’s monthly income that goes toward debt payments. Most lenders prefer a DTI ratio below 43%, although some programs may allow higher ratios under specific conditions.

4. Down Payment

The required down payment varies based on the type of loan. Conventional loans usually require at least 5-20% down, while FHA loans may require as little as 3.5%. VA and USDA loans offer options with zero down payment for eligible borrowers.

5. Loan Type and Purpose

Different types of mortgage loans (conventional, FHA, VA, USDA) have specific eligibility requirements. Additionally, lenders may consider whether the loan is for a primary residence, secondary home, or investment property.

6. Property Appraisal

Lenders require an appraisal to determine the market value of the property. The appraised value must align with the loan amount to ensure the property can serve as adequate collateral.

7. Legal Residency and Documentation

Borrowers must provide proof of legal residency or citizenship. Non-U.S. citizens may need additional documentation, such as a valid visa or green card, to qualify for a mortgage.

Meeting these eligibility criteria improves the chances of securing a mortgage loan.

Borrowers should review their financial situation and work on improving their creditworthiness before applying for a mortgage to enhance approval prospects and secure favorable terms.

Read more: Crochet Star Granny Square Step by Step